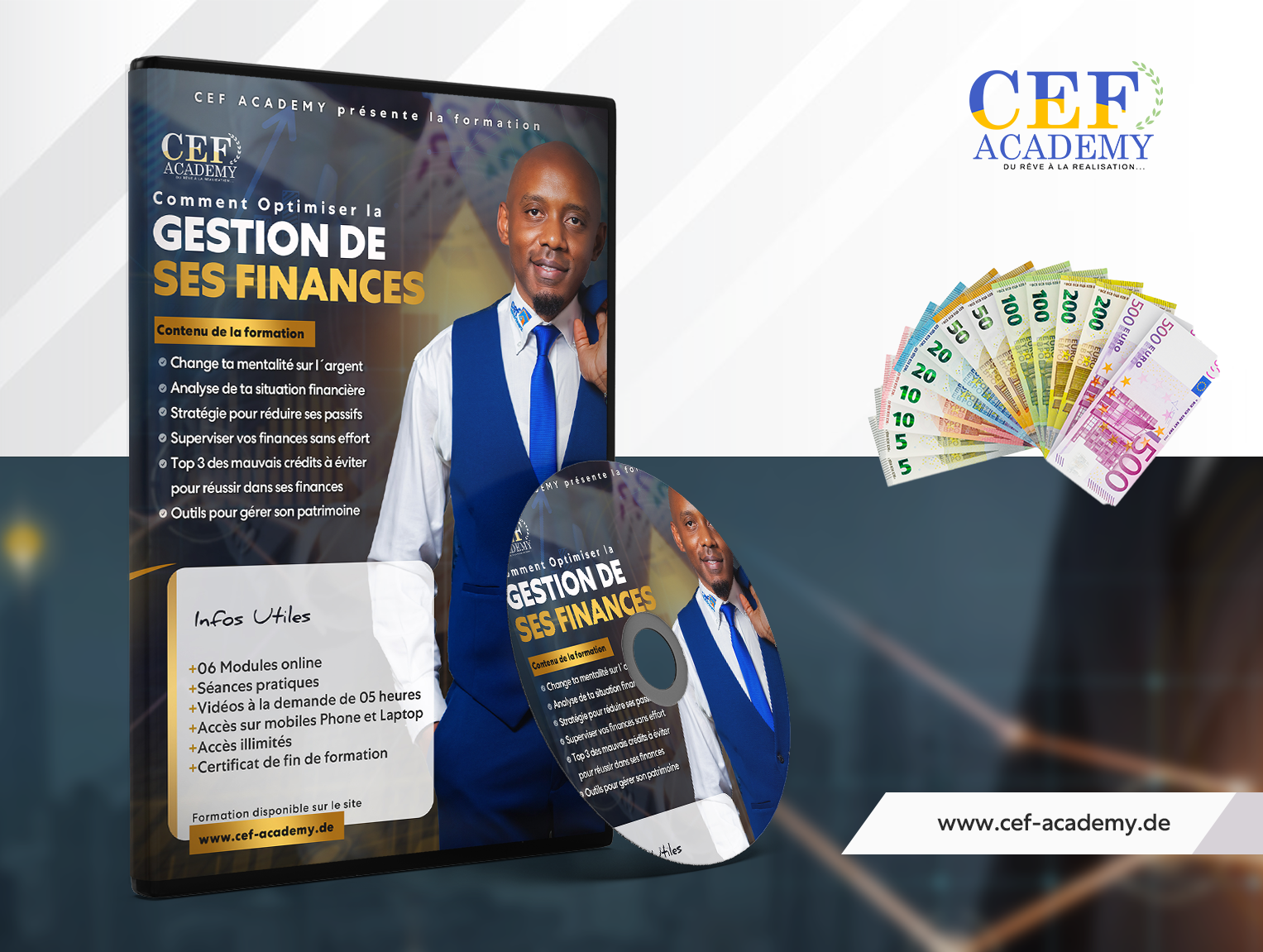

How to optimise the management of your finances

Taking the time to analyse your assets, expenses and income can help you save regularly in the future, and without having to tighten your belt.

Taking the time to analyse your assets, expenses and income can help you save regularly in the future, and without having to tighten your belt.

Are you in one of these situations?

Have you accumulated debts?

Do you have too many unnecessary expenses?

Are you living beyond your means? Are you a spendthrift?

Do you earn enough but can't save effectively?

Do you spend more than you earn?

Do you have a small salary but want to earn more? And save?

Can't you please your children? Do you deprive yourself?

Can't you manage your money? Does this cause you stress and insomnia?

During this course you will learn the basics that will allow you to optimise your finances and to save efficiently. You will be accompanied step by step.

Join the programme

Cedric Folepe reliably supports Africans living in Germany in building up their financial and real estate assets.

After arriving in Germany in 2003 with a degree in engineering, he realised early on that the system, while offering jobs for young graduates, also has a wide range of opportunities that guarantee financial freedom for ambitious people.

Thanks to real estate, he managed to make his dream come true and created the CEF Academy structure with the mission of raising awareness, advising and accompanying anyone who, like him, wishes to build a quality estate for assured financial freedom.

CEF Academy is made up of experts in several fields such as finance, taxation and real estate.

What those who follow our programmes say on a daily basis

3 Modules

Access to training